What does Zeta do?

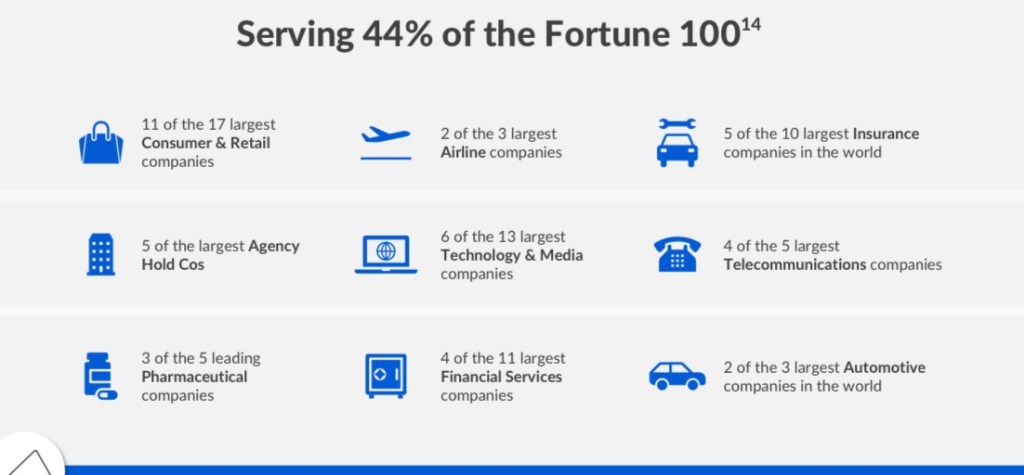

Zeta Global is a founder led, data-driven marketing technology company that uses artificial intelligence and automation to help brands acquire, grow, and retain customers across multiple channels. Zeta is not offering the same service as Google’s advertising or Meta’s advertising. Zeta aims to optimize a brand’s advertising spend by providing personalized, data-driven, omni channel solutions tailored to each customer’s needs. Unlike “competitors” Zeta is a unified platform, offering the full package, not just retention, or just acquisition. Zeta’s customer base is made up of large enterprises across many industries. They currently serve 44% of fortune 100 companies.

Zeta’s Data Cloud

Zeta’s Data Cloud, which is a proprietary identity graph built from over 235 million U.S. consumer profiles and trillions of intent signals, powers the company to offer more than just automation and definetly more than a regular advertising campaign. The data cloud allows Zeta to provide customers with more efficient targeting and personalization. For instance, the data could allow Zeta to predict which of an enterprise’s customers are likely to purchase a specific product. They can then advertise to that enterprise’s customer accordingly. The data cloud is constantly learning from the various clients that Zeta serves both on a direct basis and integrated basis (which I will explain later on). Zeta’s customers in turn, continue to spend more money with them. For instance, in Q1 2025 Zeta increased the ARPU (average revenue per user) of their super-scaled customers by 23% year-over-year.

Zeta’s two revenue segments

Zeta has two different revenue segments, which are, Direct Platform Revenue (DPR) and Integrated Platform Revenue (IPR).

Direct platform revenue accounts for ~80% of total revenue. This revenue comes from large enterprises that use Zeta’s platform directly to manage their own data, run campaigns, and optimize ROI across their current campaigns. These relationships tend to scale to a much greater dollar amount, and they are higher margin for Zeta. This is due to the fact, Zeta has more control over the user experience and can demonstrate stronger ROI.

Integrated platform revenue makes up the remaining 20% of revenue. IPR comes from marketing agencies and other partners that integrate Zeta’s technology into their own offerings. While lower-margin, IPR still provides solid growth and additional data that strengthens Zeta’s core platform.

DPR is growing faster than IPR. Zeta’s focus is on growing the higher scale, higher margin side of their business, although they are not neglecting what the IPR growth can and is doing for their business.

Zeta’s Numbers

In Q1 2025, Zeta reported:

-36% revenue growth, reaching $264 million

-53% adjusted EBITDA growth, totaling $47 million

On a GAAP basis although, Zeta remains unprofitable primarily due to significant stock-based compensation (SBC). This year, the company is projected to do $1.242 billion in revenue and $190 million in SBC, meaning SBC will be about 15% of revenue. That said, Zeta is actively cutting SBC while continuing to grow revenue at a great pace. Zeta averaged nearly 30% annual revenue growth over the past three years. This continued growth, alongside the direct cuts to the expense, should allow SBC to become much less of a drag on future profitability.

Zeta’s past Stock-based Compensation:

Looking ahead to 2028:

Management has consistently beat past guidance, and these 2028 targets look achievable, especially when considering the numbers Zeta has achieved over the last few years.

Valuation

Because Zeta isn’t yet profitable on a GAAP basis, it tends to be misunderstood and underappreciated by the broader market. At the current share price of $14, Zeta trades at just 2.5x forward sales. That’s unusually low for a company growing 30% annually and guiding for 20% revenue growth through 2028.

For comparison, The Trade Desk (TTD), who is a more mature company in the same advertising technology space, trades at a price-to-sales ratio of 15. In full year 2024, TTD posted:

-$2.44 billion in revenue (26% growth)

-$600 million in free cash flow (25% margin)

Now compare that to Zeta’s 2028 guidance:

-$2.1 billion in revenue (20% growth)

-$340 million in free cash flow (16% margin)

Zeta isn’t expected to hit TTD-level profitability, but it doesn’t need to. If Zeta simply delivers on its 2028 guidance and expands to 7.5x price-to-sales multiple (half of TTD’s current multiple), the stock would then trade at nearly $67 per share.

Even under a more conservative case, where Zeta only expands its price-to-sales from 2.5x to 4x sales, the stock would be worth $35 per share. That scenario would still offer over 30% annualized returns from 2025 to 2028. In the more bullish case, where the stock reaches $67, the compound annual growth rate would be around 68%.

Conclusion

Zeta is a high-growth differentiator in the advertising technology industry. They aim to serve their customer’s every need, whether it be retention, acquisition, or overall optimization and automation, Zeta offers it. While Zeta is an undervalued, fast-growing disruptor in the space, like any investment, there are still risks involved. However, if Zeta can continue to drive stock-based compensation down as a percentage of revenue, GAAP net income margins will soar. This would not only present major upside for the share price, but also allow management to run the company with much less risk hanging over their heads.

As always, this is not financial advice, and anything discussed during this analysis is simply for educational purposes only.