What does PayPal do?

Led by CEO Alex Chriss (who joined in 2023), PayPal Holdings is a global leader in digital payments, offering a trusted platform for individuals and businesses to send, receive, and manage money online. PayPal operates in over 200 markets and supports 436 million active accounts across its PayPal and Venmo applications. The company also owns Braintree, a payment platform that helps businesses accept online transactions.

Venmo

Venmo targets younger users more effectively than the PayPal app, particularly among Gen Z and millennials. However, Venmo is still in the early stages of its margin expansion story. Management has stated that Venmo will become an even larger growth engine in the future, particularly as monetization through merchant checkout on the platform scale. For now, Venmo has only scratched the surface of its long-term revenue and free cash flow contribution potential.

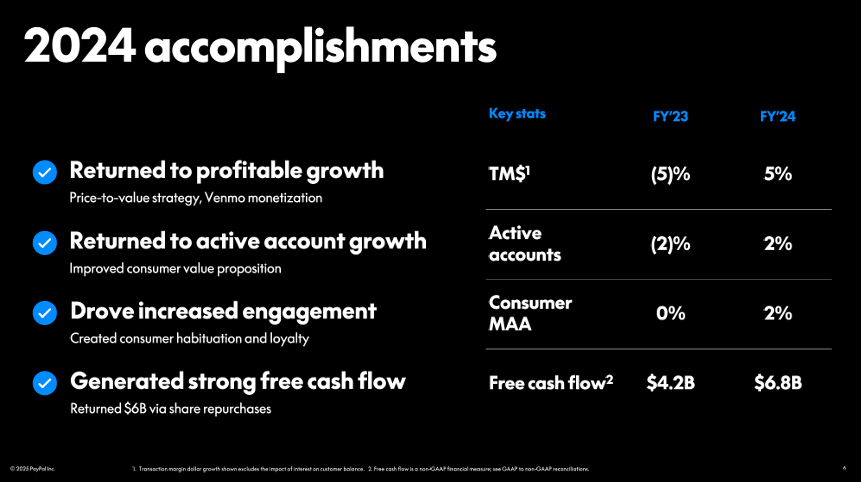

PayPal’s First Year Under Alex Chriss’s Leadership

Important Expectations for Full year 2025

-Revenue growth: 1% to 3%

-Non-GAAP EPS growth: 6% to 10% (delivered 23% in Q1 2025)

-Revenue headwind from Braintree reset: ~5 percentage points

Digesting the Numbers

CEO Alex Chriss has made it clear that PayPal is shifting focus toward profitable growth. This includes moving away from unprofitable Braintree contracts, which is expected to lift transaction margin dollars by 1% YoY in 2025. However, this shift comes with a ~5% headwind to revenue growth, as explained by CFO Jamie Miller.

For the full year 2025, analysts expect 1% to 3% revenue growth. Although revenue growth in 2025 is suffering, EPS growth is trending well, indicating that the early-stage results of the “profitable growth” vision are beginning to materialize. I view this revenue headwind as a temporary nuisance that will, in turn, allow PayPal to generate greater profits.

Share Repurchases

PayPal is no longer a high-growth early-stage company; they are transitioning to become a mature, free-cash-flow churning business. This transition includes the utilization of share buybacks. In February of 2025, PayPal authorized up to 15 billion in new share repurchases. At the current pace, PayPal is expected to buyback $6 billion to $7.5 billion worth of shares this year (repurchased $1.5 billion worth of shares in Q1 of 2025). Assuming PayPal repurchases $6.75 billion worth of shares in the full year 2025 (midpoint of expectation), they would be buying back 9.5% of shares. This is a very substantial share repurchase program, and it will be massively accretive to shareholders.

2026 Recovery

Revenue growth will accelerate in 2026 as the Braintree reset fades. As the company moves past these short-term headwinds, PayPal’s true earnings power will begin to shine.

Another important tailwind is PayPal’s new advertising business, which leverages its massive transaction data to help businesses create targeted campaigns. This business has potential to become a valuable growth engine in the years ahead.

2026 analyst expectations:

-Revenue of $34.59 billion (5.91% increase)

-Non-GAAP EPS of $5.62 (12.2% increase)

What Does this Mean for the Share Price of PayPal?

Assuming PayPal delivers on 2026 expectations, and the P/E ratio stays at the same level (16.4). The stock will trade at $92 a share. This means 24.1% upside, even with no P/E expansion.

Other possible share price outcomes in 2026 (bull and bear case):

Bullish Scenario- P/E expands to 20, share price $112.4 (51.6% upside)

Bearish Scenario– P/E compresses to 14, EPS growth is only 8%, share price $76 (2.5% upside)

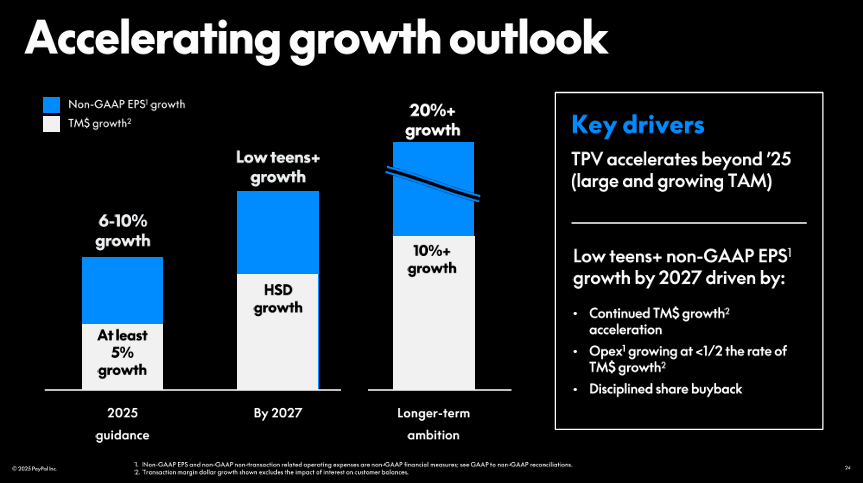

Management’s expectation for Growth in future years:

What This Would Mean for PayPal’s Share Price in 2027

Although PayPal has provided its longer-term growth target for past 2027; the target seems to be ambitious so I will not model past the year 2027.

2027 Share Price:

Bullish Scenario– P/E expands to 20, 14% non-GAAP EPS growth, share price $128 (72.6% upside)

Base Scenario- P/E remains at 16.4, 12% non-GAAP EPS growth, share price $103 (38.9% upside)

Bearish Scenario-P/E compresses to 14, 8% non-GAAP EPS growth, share price $85 (14.6% upside)

Conclusion

PayPal is a low-risk investment that offers significant upside potential, especially in the next 1-2 years. Alex Chriss’s profitable growth strategy, paired with the substantial number of shares being repurchased, is providing a path to consistent and predictable returns. While Wall Street may believe PayPal is a dying company being eaten away by competition, the company is a global payment innovator returning major amounts of free cash flow to shareholders. Beyond the core PayPal application, the company has two underappreciated growth drivers in Venmo and PayPal Ads, both of which could drastically enhance long-term returns if execution aligns.

Disclaimers

Nothing discussed in this article is financial advice. Always do your own research before making an investment. The future share price calculations in this article are made using the share price as of market close on July 18th, 2025 ($74.17).